Digital Assets: Are You Prepared to Protect Them?

A key component of a contemporary estate plan is one that is easy to overlook—a plan for handling your digital assets with financial or personal value in the event of your incapacity or death. Chances are your daily life is digitally archived by way of emails, text messages and social media posts, you conduct your banking and investment activity online, and you have digitally stored airline miles or other commercial activity rewards. You may even have cryptocurrency. Your “real” and digital lives are likely becoming more and more intertwined. But are your digital assets incorporated into your estate plan?

Types of Digital Assets and Liabilities

The universe of digitally stored assets is expanding exponentially, and the forms are constantly morphing to fit different aspects of our social, professional, financial and family worlds. As a result, it is more important now than ever before to address your digital assets in your estate planning.

Just some of the many digital items to consider when updating an estate plan include:

- Social media accounts, such as Facebook, Instagram and Twitter

- Online banking and investment accounts

- Other sources of biographical and financial information stored in the cloud

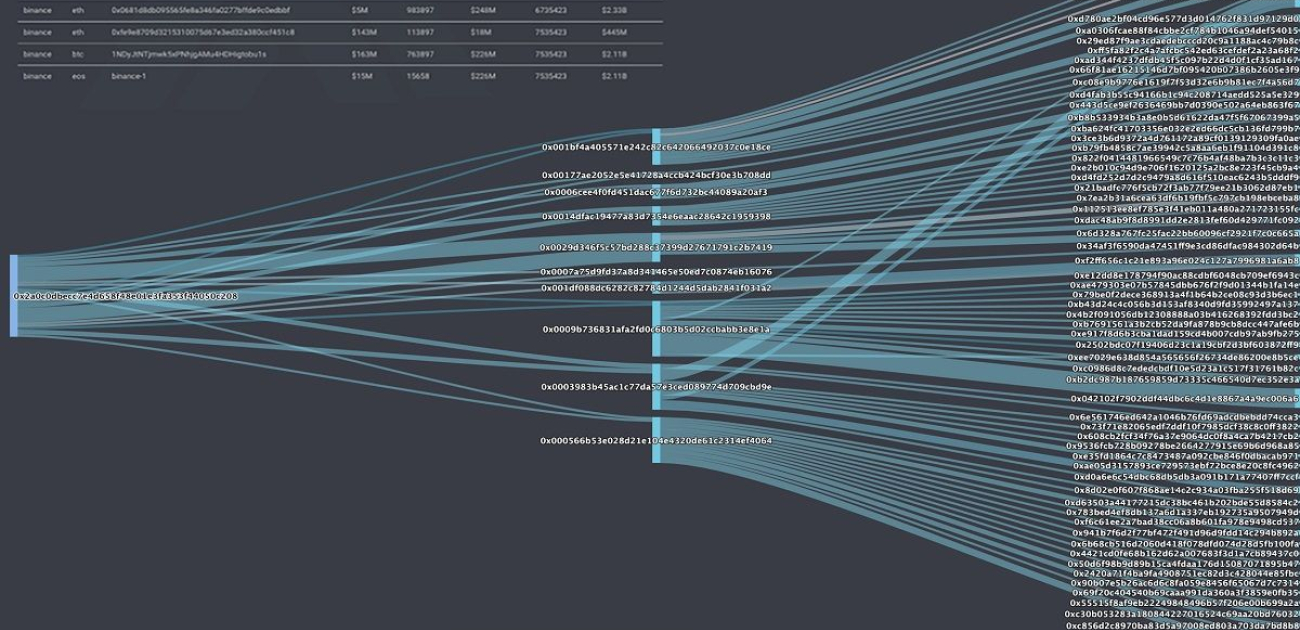

- Digital currencies, such as Bitcoin

- Rights to domain names, blog names or website names

- Rights and liabilities associated with digital licenses or perpetually renewable subscriptions

- Information associated with gamer and virtual reality worlds

- Revenue-generating websites and e-commerce sites

- Blogs and other forms of internet content in which you may have copyrights

- Photos, artwork and images associated with a variety of websites and online accounts.

Relevant Law

When estate planning for digital assets, it is important to obtain legal guidance because of the varying laws that affect different types of digital assets.

At the federal level, there are two laws of primary import. One is the Computer Fraud and Abuse Act (the “CFAA” codified at 18 U.S.C. §1030), which penalizes unauthorized or improperly authorized access to and use of computers or digital data. This law is of concern to your personal representative (a.k.a., executor), family members, friends or others that you have not properly authorized to access your digital assets or accounts in the event of your disability or death. Your ability to properly authorize access is more difficult where a digital provider’s terms of service agreement prohibits the sharing of usernames and passwords.

The second federal law is the Stored Communications Act (the “SCA” codified at 18 U.S.C. Ch. 121, §§2701-2712), which penalizes service providers for disclosing the content of your digital communications, unless the disclosure is made to an authorized party. This law is intended to protect your property and privacy rights, but can make it difficult or even impossible for your designees to access, for example, the content of your email account in the event of your incapacity or death. The problem lies in that fiduciaries are not explicitly listed as authorized parties in the SCA, and as a result, service providers have historically taken the position that the Act prevents them from disclosing content to fiduciaries.

Many states also have their own laws on digital assets. Most follow a uniform approach for authorizing access to digital assets while protecting digital providers and custodians who follow prescribed procedures for granting that access. These uniform laws distinguish between electronic communications (such as e-mails or text messages) and other types of digital assets, and set forth certain procedures for you to give access to your personal representative, attorney-in-fact under your durable power of attorney, trustee, guardian, or conservator (together, your “fiduciaries”). The uniform laws set forth the presumption that a fiduciary is authorized to access most digital information, but is not authorized to access the content of electronic communications unless you have specifically provided for this in a service provider’s “online tool” or in your estate planning documents.

Importantly, at the time of this publication, Massachusetts is considering but has not yet adopted these uniform laws. So, Massachusetts does not have a statutory presumption in favor of access. In addition, only a handful of service providers offer online tools for granting access to digital assets. Consequently, if you are a Massachusetts resident and you want your fiduciaries to be able to access any of your digital assets in the event of your incapacity or death, it is important that you build explicit authorization into your estate planning documents.

Actions to Consider

To facilitate the handling of your digital assets according to your wishes, there are several steps you should consider taking, including the following:

- Update Your Estate Plan. Consideration of digital assets in the event of incapacity or death is a relatively new phenomenon, and if your estate planning documents are five or more years old, they may not explicitly address digital assets. Your estate planning attorney can resolve this by adding certain provisions to your powers of attorney, wills and trusts that properly authorize your fiduciaries to access, manage, dispose of, and distribute your digital assets.

- Inventory Your Digital Assets. Preserving a list of your digital accounts, usernames and passwords can give your fiduciaries a meaningful head start with respect to identifying your digital assets and determining the appropriate steps to make authorized access. You could store this information in a secure location, such as a bank deposit box or an immobile fireproof safe within your home. You could also store the information with a digital service provider, such as Dashlane, LastPass or Everplans. In any case, remember to update your inventory at least annually, so that the information remains current.

- Make Sure Your “Online Tools” Are Consistent With Your Wishes. A small handful of online service providers, most notably, Facebook and Google, have online tools for authorizing account access in the event of death or disability. If you use such tools, be careful to do so in a manner consistent with the instructions provided in your estate plan. A contrary instruction in the tools can override the instructions in your estate plan.

- Periodically Save Digital Data. To preserve truly critical data, you might want to consider periodically backing up digital data and property to a flash drive or the cloud. If you do so, it is important that your fiduciaries know of the existence of the backups.

- Decide If Multiple Fiduciaries are Needed for Different Types of Digital Assets. For many, building a general authorization of fiduciaries to access digital assets into estate planning documents is all that is warranted. Others may want to name different fiduciaries to have access to certain digital assets. For example, your personal representative will need access to your online bank statements for purposes of valuing and distributing your estate, but is that same person the right individual to operate and manage your e-commerce business, or sell or license any valuable digital content you have created? There may be cases where a more detailed and customized plan for digital assets is suitable.

By taking a little time now to address the handling of your digital assets in the future, you’ll pave the way for your fiduciaries to be successful in accessing and dealing with your digital assets with minimized exposure.

This advisory should not be construed as legal advice or legal opinion on any specific facts or circumstances. The contents are intended for general informational purposes only, and you are urged to consult your own lawyer concerning your situation and any specific legal questions you may have.

Do you want more information?

Kerry Spindler

Kerry SpindlerKerry Spindler is an estate and tax planning lawyer, helping individuals and families to maneuver through sophisticated tax and charitable planning issues. She handles all aspects of estate planning, estate administration and trust administration.