COVID Impact as a Standalone Indemnity in M&A Transactions

The COVID virus has ushered in unprecedented and challenging times for our country and the global community. From the deeply personal pain and suffering caused by the virus as a health pandemic to behavioral adjustments in the consumer population at large (“social distancing,” etc.), to every day, but very real, burdens created by business closures and shelter in place orders, the full force and impact of the virus on our society won’t be known for a long time. Apart from these personal and social consequences, of course, the economic downturn is very real and upon us.

And yet businesses move forward, even in a very different and challenging environment. Certainly, the COVID virus is impacting the way M&A transactions are being looked at, papered, and implemented.

Buyers are focusing more aspects of their due diligence on virus-related matters. Transaction parties are negotiating expanded or new representations to address the effect of COVID on the target business, as well as the policies and protocols for dealing with those effects. Sellers are seeking broader disclosures of COVID uncertainties. Parties are also looking whether the pandemic constitutes a “material adverse effect” or “material adverse change” under the terms of their agreement. And, significantly, representations and warranties insurance (RWI) providers are seeing to ensure that COVID-related risks are outside of the scope of their policies.

Another potential mechanism in the M&A context to address risk allocation as to COVID matters is the standalone indemnity.

M&A Indemnities: General and Standalone

Standard indemnity provisions in M&A purchase agreements typically provide that the “indemnitor” (the party providing indemnification) indemnify, defend, and hold harmless the “indemnitees” (the parties receiving indemnification) for losses incurred by the indemnitees relating to the agreement or the underlying transaction. These indemnity provisions are generally comprised of “general” indemnities and “standalone” indemnities.

“General indemnities” address, and provide indemnification for, breaches of the purchase agreement or other ancillary documents (e.g., breaches of representations, warranties, or covenants). “Standalone” indemnities cover specific topics apart from the general indemnities, typically without reference to an underlying breach of the representations, warranties, or covenants.

General indemnities are typically subject to both “baskets” (whereby the indemnitor is not liable for breaches until a specific threshold of indemnitee losses are reached) and caps (limiting the indemnitor’s overall liability for breaches). Further, the underlying representations and warranties to which the general indemnities apply often expire after a prescribed time period, usually prior to the otherwise applicable statute of limitations.

In contrast, standalone indemnities might not be subject to baskets, caps, or specific time periods (though the parties are free to, and sometimes do, negotiate specific baskets, caps, and expiration dates for these indemnities). One additional distinction is that standalone indemnities may be limited to third party claims (i.e., losses suffered by an indemnitee subject to a third-party claim), whereas general indemnities would cover third party claims as well as breaches solely between buyer and seller (“two-party” or “direct” claims).

Despite the differences, there is almost always some overlap (and some redundancy) between general and standalone indemnities. Most significantly, the topics covered by standalone indemnities will usually also be addressed, in varying forms and manners, in the seller’s representations and warranties.

Generally speaking, standalone indemnities cover either: (a) matters arising during the buyer’s diligence that pose unusual or unexpected risk; or (b) matters for which the buyer does not wish to assume any post-closing responsibility, regardless of whether those matters constitute a breach otherwise covered in the purchase agreement, or arose as a particular concern during the buyer’s diligence.

One common example of a “category” of matters which buyers generally wish to leave on the seller side of the risk ledger is pre-closing taxes of the target company. Buyers often, not unreasonably, argue that they should never be responsible for paying the seller’s taxes, regardless of whether a breach of the tax representation has occurred.

Deal Trends Re Standalone Indemnities

Every other year since 2005 the ABA has released its Private Target Mergers and Acquisitions Deal Point Studies (the “ABA studies”). The ABA studies examine purchase agreements of publicly available transactions involving private companies. These transactions range in size but are generally considered as within the “middle market” for M&A transactions; the median transaction value within the 2019 study was $145 million.

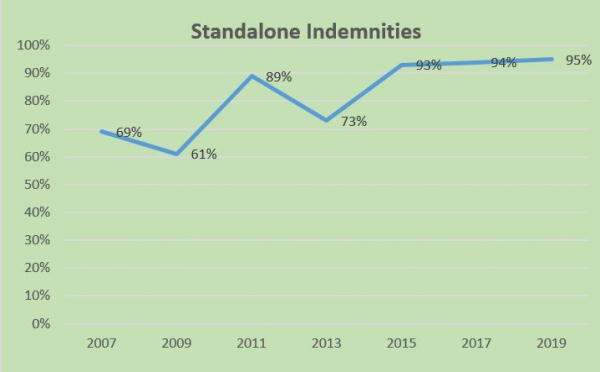

Since 2007, the percentage of transactions including standalone indemnities increased from 69% to 95% in 2019. The chart below (reflecting data from the ABA studies) shows this trend.

This data shows that standalone indemnities are now a near-ubiquitous element in private company M&A transactions.

The most common topics covered by standalone indemnities relate to taxes, dissenters claims, and unpaid seller transaction expenses. Apart from these, over ¾ of reported transactions included standalone indemnities for “other” issues: these likely include fact-specific matters identified during diligence and agreed by the parties to be the seller’s responsibility.

COVID Impact as a Standalone Indemnity

The effect of COVID on a target’s pre-Closing business is potentially the “type” of topic or matter that a buyer might conclude should not be “its problem.” Buyers may reason that their deal pricing and modeling did not take into account COVID-related economic risk, at least through closing. They may view COVID issues, and their impact on the target business, as one of those relatively “toxic” categories of risks that they consider to be “on the seller’s watch.”

To a large extent, buyers are already seeking to position COVID risk back onto sellers, through virus-specific representations and warranties, exclusion of COVID matters from the seller’s material adverse change (MAC) representations (even if included for purposes of the buyer’s “MAC absence” closing condition), and usage of contingent earn-outs to deal with pricing uncertainties. And, similarly, insurers are striving to ensure that COVID-related losses fall within the relatively small number of risk categories for which their RWI policies exclude coverage.

At the same time, sellers understandably will assert that the impact of COVID is so widespread, worldwide, on businesses, and is so devoid of any unique or disparate nexus to its own business, that they should not be expected to underwrite these risks. In addition, it may well be difficult to determine a cause and effect relationship between the virus and any given economic loss at the business level. After all, if a key customer cancels a contract without explanation, how can one really know - - with a level of certainty appropriate for an indemnity claim - - that that cancellation was “COVID related?”

This conversation and negotiation between sellers and buyers (and with their RWI insurers) is evolving. If the parties agree that, conceptually, all or some COVID-related impact on the target business should be borne by the seller, a standalone indemnity - -a mechanism already commonly used in M&A agreements to deal with unusual or “toxic” risks - - may, alongside seller representations and warranties, be an important part of the overall structural solution.

Do you want more information?

Daniel R. Avery

Daniel R. AveryPublic and privately-held international and domestic companies with cross-border and multi-country M&A transactions turn to Dan Avery, a Director, for legal representation. Dan is a member of the ABA’s committee that publishes private company M&A deal point studies and of the M&A Advisory Board for the Bloomberg M&A Law Reporter.