Opportunity Zones Steal the Show

The Gaylord National Resort & Convention Center played host to the ICSC's 2019 Mid-Atlantic Conference and Deal Making event last week. After being snowed out last year, the conference rebounded with high attendance and spectacular views of the Potomac River. The overall mood of attendees was surprisingly upbeat given the looming prospect of a downturn often discussed at other real estate conferences. The Washington, D.C. area is still very much basking in the aftermath of the Amazon HQ2 decision, with the prospect of tens of thousands of well-educated and well-compensated people moving to the area for jobs, housing and shopping nearby. Most participants surveyed indicated that deal flow was proceeding at a good pace, with much of the focus continuing to be on large mixed use projects. That being said, there were fewer developer booths at the show than in the past several years, and very few large tenant booths. As usual, much of the action took place in meetings in the various broker booths.

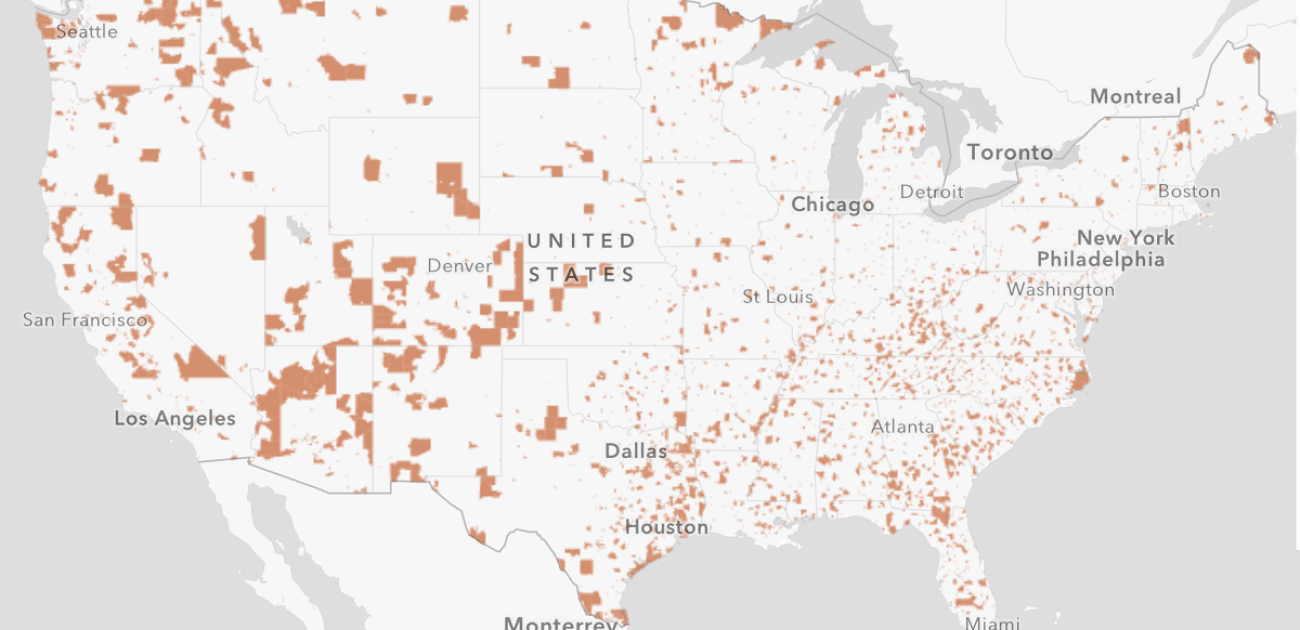

The conference began with a panel discussion on Opportunity Zones. By way of background, the Tax Cuts and Jobs Act of 2017 created an investment tool by which capital gains could be deferred and potentially excluded by investing in Opportunity Zones. By June 8, 2018, each state and territory designated (and the Treasury Department certified) certain census tracts with poverty rates above 20% as Opportunity Zones. The Tax Cuts and Jobs Act of 2017 was light on details, so investors were reticent to act until the Treasury Department issued proposed regulations on October 19, 2018 clarifying certain provisions regarding Opportunity Zones. While some investors forged ahead forming Opportunity Zone funds to purchase Opportunity Zone properties, many investors remained reticent hoping for further clarification from the Treasury Department, which was originally expected by the end of 2018 before the government shutdown derailed that timeline.

For the panel discussion on Opportunity Zones, every seat in the room was filled, with many people standing in the aisles, because everyone wanted to get the inside scoop on Opportunity Zones from Ja’Ron Smith, special assistant to the President for the White House Office of Legislative Affairs. Much to the dismay of the audience, Smith had little guidance to offer. He saw his role more as the collector of feedback (which other panelists were happy to provide) to inform the next set of regulations, which Smith said will, among other things, better define “substantial improvement.” (One way to qualify property as Opportunity Zone business property is to substantially improve the property (IRC Sec. 1400Z-2(d)(2)(D)(i))).

The Opportunity Zone panel discussion was the most content laden event of the conference, as the other events were very light-hearted. A game of Family Feud pinned developers against retailers as they were asked to identify the largest quick serve restaurants, the largest malls, the biggest online retailers and the top items purchased at a fueling station (call or email us for the answers). Several events consisted of brief getting-to-know-you interviews with various Mid-Atlantic developers and new retailers. Möge Tee, which has over 300 stores in Asia, is bringing bubble tea and other unusual tea concoctions to the US market, so be on the lookout for avocado cheese tea coming to a store near you!

Do you want more information?

Joseph T. EgglestoneI help land owners, developers and lenders through the processes of buying and selling commercial real estate (office, multifamily, retail and industrial), structuring their various real estate entities, financing their purchases and leasing their property.

Joseph T. EgglestoneI help land owners, developers and lenders through the processes of buying and selling commercial real estate (office, multifamily, retail and industrial), structuring their various real estate entities, financing their purchases and leasing their property.