Articles

The Protection Plan for Whistleblowing in the EU - the Fight Against Tax Fraud and Evasion

Maurizio Bottoni from Interconsulting Studio Associato on

Maurizio Bottoni from Interconsulting Studio Associato on

Tax fraud and tax evasion affects us all. It occurs within a country and across different countries both within the EU and globally. For this reason, a single country cannot solve the problem on its own.

Fiscal Benefit to Purchase New Machineries

Federico Rossi from Studio Rossi-Gerosa Commercialisti Associati on

Federico Rossi from Studio Rossi-Gerosa Commercialisti Associati on

A great chance is given to companies: the 2017 budget law confirm the “super amortization” process, that gives the possibility to amortize at 140% the new capital goods that Italian companies buy.

Talking about Present and Future of the Italian Tax Justice

Gilberto Gelosa from Interconsulting Studio Associato on

Gilberto Gelosa from Interconsulting Studio Associato on

Tax justice statistical data show that during last year (2016) the amount of “pending litigations” is considerably lowered with respect to 2015. In details, the most relevant decrease concerns “small value” tax litigations.

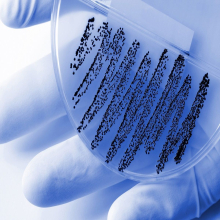

Healthcare-Associated Infections (HAI) and Principle of Prevention

Manuel Pérez Taboada from CCVZ on

Manuel Pérez Taboada from CCVZ on

Healthcare-Associated Infections (HAI), occur when a patient contracts a disease, gets a virus, a bacteria, or other microorganism during his or her stay in a hospital or at any other health care institution.

Transfer Pricing Documentation and Country-by-Country Reporting

Maurizio Bottoni from Interconsulting Studio Associato on

Maurizio Bottoni from Interconsulting Studio Associato on

The Base Erosion and Profit Shifting Action Plan adopted by the OECD and G20 countries in 2013 recognised that enhancing transparency for tax administrations is a crucial aspect for tackling the BEPS problem.

Most Read

English