Articles

Multilateral Convention to Implement Tax Treaty Did not Enter in Force in Italy Yet

Maurizio Bottoni from Interconsulting Studio Associato on

Maurizio Bottoni from Interconsulting Studio Associato on

The Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting, adopted on 24 November 2016, is one of the outcomes of the OECD/G20 Project to tackle Base Erosion and Profit Shifting.

VAT Regime of the Detachment of the Workers

Maurizio Bottoni from Interconsulting Studio Associato on

Maurizio Bottoni from Interconsulting Studio Associato on

Detaching an employee is a temporary change in the employer’s job at another employer, according to the definition provided by law.

New Definition of Countries with Privileged Tax Status

Maurizio Bottoni from Interconsulting Studio Associato on

Maurizio Bottoni from Interconsulting Studio Associato on

Italian Government has just introduced a new definition of countries with privileged tax status, effective from the fiscal year starting after the fiscal year in progress

Special Tax Regime for Retired Individuals Who Move to Italy

Maurizio Bottoni from Interconsulting Studio Associato on

Maurizio Bottoni from Interconsulting Studio Associato on

A special tax regime has been just introduced in Italy, effective from January 1, 2019, in favor of retired individuals who receive a foreign pension, decide to move in Italy.

Recent Modifications of the Barcelona GMP on Issues Related to Housing Policies

Marcos Martínez from Manubens Abogados on

Marcos Martínez from Manubens Abogados on

Informative note on several recent modifications of the Barcelona General Metropolitan Plan on issues related to some specific real estate sales policies.

New Italian Rules for CFC

Maurizio Bottoni from Interconsulting Studio Associato on

Maurizio Bottoni from Interconsulting Studio Associato on

Effective from the fiscal year starting after the fiscal year in progress to December 31, 2018 (i.e. from January 1, 2019 for calendar year companies), new Italian CFC rules were introduced.

Argentina: Tax and Labor Benefits for Companies of the Future

Pablo Semenzato from CCVZ on

Pablo Semenzato from CCVZ on

The National Government seeks to promote a "Knowledge Economy Law" that replaces the current Software Law, with the ambitious objective of covering such important areas as robotics and biogenetics.

A New Judgment of the Court of Justice of European Union Aim to Provide Some Equilibrium Between the Intellectual Property Rights, and Other Fundamental Rights

Natalia Vera Matiz from Vera Abogados on

Natalia Vera Matiz from Vera Abogados on

Intellectual property must be protected, and the holders of copyright have to count with several means in order to protect it, there have to be a fair balance with other rights at stake.

The New Humanism in Post Modernity and the Role of Independent Directors

Gianluigi Longhi from Studio Longhi Associato on

Gianluigi Longhi from Studio Longhi Associato on

"The return to the ancients, understood as a return to the beginning, is what gives strength and life to everything"

Comments to the Opinion of the European Commission Regarding the 720 Model

Salvador Balcells i Iranzo from Manubens Abogados on

Salvador Balcells i Iranzo from Manubens Abogados on

In recent days the Motivated Opinion that the European Commission addressed to the Kingdom of Spain in February 2017 in relation to model 720 has been made public.

Italy Introduced Mandatory e-invoicing from January 1st, 2019. Are You Ready?

Maurizio Bottoni from Interconsulting Studio Associato on

Maurizio Bottoni from Interconsulting Studio Associato on

Italian Parliament approved the compulsory introduction, with some exemptions, of the electronic business-to-business (B2B) invoicing, effective from January 1st, 2019.

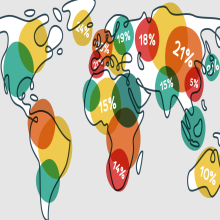

Colombia Becomes an OECD Member Country

Carolina Vera from Vera Abogados on

Carolina Vera from Vera Abogados on

Last May 2018 the Commercial Issues Committee endorsed the Colombia affiliation to the OECD, which means that it becomes Member No. 37 of the Organization, and it is the third Latin American country accepted as a member after Mexico and Chile.

The 2018 ICSC New York Deal Making Conference and The Emergence of Digital

David J. Rabinowitz from Goulston & Storrs on

David J. Rabinowitz from Goulston & Storrs on

The ICSC New York Deal Making Conference was held at the Jacob Javits Convention Center from December 4 – 6. NYDMC is ICSC’s second largest conference, with about 10,000 in attendance this year.

Most Read

English