Articles

Portuguese Citizenship for Sephardic Jewish Descendants

Filipe Consciência from Caria Mendes Advogados on

Filipe Consciência from Caria Mendes Advogados on

The Portuguese citizenship, by naturalization, is granted to the descendants of Portuguese Sephardic Jews, provided that the following requirements are met.

Adjustments Regarding Transfer Pricing Are Not Relevant For VAT Purposes

Federico Rossi from Studio Rossi-Gerosa Commercialisti Associati on

Federico Rossi from Studio Rossi-Gerosa Commercialisti Associati on

The Court of Cassazione, with the sentence n. 2240 of 30 January 2018, examined the effects of transfer pricing adjustments on VAT, reaching a European-oriented conclusion.

Bankruptcy Lease Auctions – Landlords Can Play Too

Vanessa Moody from Goulston & Storrs on

Vanessa Moody from Goulston & Storrs on

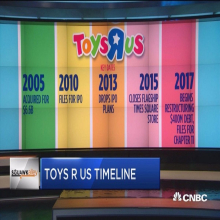

Toys “R” Us filed for bankruptcy in September 2017, with hopes that a strong holiday season would facilitate a successful reorganization.

No Relief in Sight from Website Accessibility Lawsuits

Matthew P. Horvitz from Goulston & Storrs on

Matthew P. Horvitz from Goulston & Storrs on

In February 2017, we reported on a surge in website accessibility lawsuits brought under the Americans with Disabilities Act. This litigation trend has accelerated over the past year and shows no signs of slowing down.

#Trending: Omnichannel Loyalty and Leveraging Social Media Channels

Zachary Mykulak from Goulston & Storrs on

Zachary Mykulak from Goulston & Storrs on

Technological advancements allow consumers to browse and buy products on smartphones and tablets, bringing an unlimited number of retail options to their fingertips—literally.

The tax aspects of e-commerce

Aline Arbesú from Alvarez Valenzuela Abogados on

Aline Arbesú from Alvarez Valenzuela Abogados on

e-commerce must be understood already necessarily in terms of a systematized functional structure, by virtue of which it is possible to carry out any type of transactions electronically.

Bringing Residential Uses to Existing Shopping Centers- A Win Win

David A. Lewis from Goulston & Storrs on

David A. Lewis from Goulston & Storrs on

Tenant curation, experiential retail, and social media-based marketing are thriving trends in today’s brick-and-mortar shopping center industry. Retail is not the only real estate asset class susceptible to trends.

Settlement Opens Door For Outer Borough Outlet Centers

George W. Evans from Goulston & Storrs on

George W. Evans from Goulston & Storrs on

Radius restrictions are very common provisions in retail leases. They protect a landlord’s investment in its property and in a particular lease by preventing tenants from operating additional stores within a set area.

Is your Business prepared for the new General Data Protection Regulation (GDPR) due to come into effect on 25th May 2018?

Mandeep Johal from Manubens Abogados on

Mandeep Johal from Manubens Abogados on

The EU General Data Protection Regulation adopted in May 2016, becomes directly applicable in all EU member states without the need for local implementing legislation on May 25th, 2018. Is Your Business Ready?

Facial Recognition in Retail: “Attention all Shoppers: We Already Know Everything about You”

Louise Giannakis from Goulston & Storrs on

Louise Giannakis from Goulston & Storrs on

Are you worried that “Alexa” is listening to your conversations? Do you cover your laptop camera with tape? Well, it looks like even stepping into the mall may require full-body armor if you wish to keep your basic data truly private.

Foreign Retailers Entering New Markets: Finding A Home Of One’s Own

Matthew E. Epstein from Goulston & Storrs on

Matthew E. Epstein from Goulston & Storrs on

The first task facing a retailer entering a new market? To find its customer. This chore takes on more significance for foreign retailers venturing into a complex, expansive and heterogeneous market such as the United States.

UAE Offshore Companies: What are They and Why May Be of Your Choice

Maria Evangelou from The Corpro on

Maria Evangelou from The Corpro on

“Offshore Company” is the term used for companies established under jurisdictions that allow them to operate anywhere other than in the specific jurisdiction they are regulated in.

Mini Voluntary Disclosure for Resident in Italy

Maurizio Bottoni from Interconsulting Studio Associato on

Maurizio Bottoni from Interconsulting Studio Associato on

The Italian government has approved a mini voluntary disclosure in favor of tax payers resident in Italy who, previously, were resident abroad or worked continuously abroad in border areas and neighboring countries.

Most Read

English