Articles

Increase of the Tax Advantages for People “Incoming” to Italy

Maurizio Bottoni from Interconsulting Studio Associato on

Maurizio Bottoni from Interconsulting Studio Associato on

With the Law Decree n. 34 dated April 30, 2019, the Italian Government has just modified the tax special regimes provided in favor of researchers and lecturers (see my previous article of 2017) and other “incoming” people who decide to move to Italy. The above mentioned tax regimes are granted in order to encourage the scientific and technological development in Italy and “incoming” of human capital and provide important tax exemption from IRPEF (Italian personal income tax) and IRAP (Italian regional income tax) purposes.

The Tax Treaty Provisions Can Be Applied Directly in the Italian Income Tax Return

Maurizio Bottoni from Interconsulting Studio Associato on

Maurizio Bottoni from Interconsulting Studio Associato on

According to Italian tax law, some specific incomes are taxable in Italy through a substitute withholding tax when are paid to foreign beneficiaries.

The French “Prelevaments Sociaux” Are Deductible From Italian Income Tax

Maurizio Bottoni from Interconsulting Studio Associato on

Maurizio Bottoni from Interconsulting Studio Associato on

According to article 6 of the tax treaty in force between Italy and France “income from immovable property, including income from agriculture or forestry, may be taxed in the State in which such property is situated”.

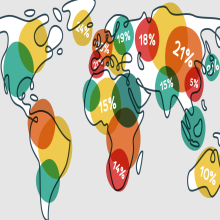

Place of Supply of Telecommunications, Broadcasting or Electronically Services to Non-Taxable Persons (B2C)

Maurizio Bottoni from Interconsulting Studio Associato on

Maurizio Bottoni from Interconsulting Studio Associato on

Actually, the above mentioned services – when supplied to non-taxable persons of member States - are subject to VAT in the member States of the client.

Holding and Managing Investments From the Netherlands

Hans de Kruijs from Bos van der Burg Advocaten on

Hans de Kruijs from Bos van der Burg Advocaten on

The Netherlands has been tried and tested as an internationally accepted and widely used jurisdiction to establish investment holding platforms.

Update: Tip Pooling by Restaurant Owners is Guided by Tip Income Protection Act of 2018

Timothy H. Watkins from Goulston & Storrs on

Timothy H. Watkins from Goulston & Storrs on

When we last looked at tip pooling at restaurants and who would be permitted to be included, the laws and regulations were in flux. Since then, the Tip Income Protection Act of 2018 was signed into law.

Amendments To The Cyprus Investment Program

Maria Evangelou from The Corpro on

Maria Evangelou from The Corpro on

Cyprus Cabinet approved a series of changes to the Cyprus Investment Program, based on which, non–Cypriot entrepreneurs/ investors and members of their families may submit applications for partaking in the Program.

VAT Regime of the Detachment of the Workers

Maurizio Bottoni from Interconsulting Studio Associato on

Maurizio Bottoni from Interconsulting Studio Associato on

Detaching an employee is a temporary change in the employer’s job at another employer, according to the definition provided by law.

New Definition of Countries with Privileged Tax Status

Maurizio Bottoni from Interconsulting Studio Associato on

Maurizio Bottoni from Interconsulting Studio Associato on

Italian Government has just introduced a new definition of countries with privileged tax status, effective from the fiscal year starting after the fiscal year in progress

Special Tax Regime for Retired Individuals Who Move to Italy

Maurizio Bottoni from Interconsulting Studio Associato on

Maurizio Bottoni from Interconsulting Studio Associato on

A special tax regime has been just introduced in Italy, effective from January 1, 2019, in favor of retired individuals who receive a foreign pension, decide to move in Italy.

New Italian Rules for CFC

Maurizio Bottoni from Interconsulting Studio Associato on

Maurizio Bottoni from Interconsulting Studio Associato on

Effective from the fiscal year starting after the fiscal year in progress to December 31, 2018 (i.e. from January 1, 2019 for calendar year companies), new Italian CFC rules were introduced.

Argentina: Tax and Labor Benefits for Companies of the Future

Pablo Semenzato from CCVZ on

Pablo Semenzato from CCVZ on

The National Government seeks to promote a "Knowledge Economy Law" that replaces the current Software Law, with the ambitious objective of covering such important areas as robotics and biogenetics.

Comments to the Opinion of the European Commission Regarding the 720 Model

Salvador Balcells i Iranzo from Manubens Abogados on

Salvador Balcells i Iranzo from Manubens Abogados on

In recent days the Motivated Opinion that the European Commission addressed to the Kingdom of Spain in February 2017 in relation to model 720 has been made public.

Most Read

English